Exactly How Livestock Threat Protection (LRP) Insurance Policy Can Protect Your Livestock Financial Investment

In the realm of animals investments, mitigating threats is vital to guaranteeing economic security and development. Livestock Threat Defense (LRP) insurance coverage stands as a trusted shield versus the unpredictable nature of the marketplace, providing a critical method to protecting your properties. By delving right into the intricacies of LRP insurance coverage and its multifaceted advantages, livestock manufacturers can strengthen their investments with a layer of protection that goes beyond market variations. As we discover the realm of LRP insurance policy, its role in safeguarding animals investments comes to be progressively apparent, guaranteeing a course towards sustainable economic resilience in an unpredictable industry.

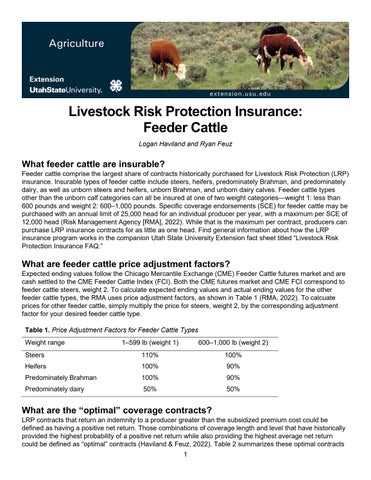

Comprehending Livestock Risk Security (LRP) Insurance Policy

Recognizing Livestock Risk Protection (LRP) Insurance is vital for livestock producers seeking to alleviate monetary dangers connected with rate fluctuations. LRP is a government subsidized insurance product created to protect producers against a decline in market value. By providing coverage for market rate decreases, LRP helps producers secure a floor rate for their livestock, ensuring a minimum degree of income no matter market variations.

One trick facet of LRP is its flexibility, permitting producers to customize insurance coverage degrees and plan sizes to match their certain requirements. Manufacturers can pick the number of head, weight array, insurance coverage rate, and protection period that align with their manufacturing goals and take the chance of tolerance. Comprehending these personalized options is vital for producers to properly handle their cost risk exposure.

In Addition, LRP is readily available for numerous animals kinds, including cattle, swine, and lamb, making it a versatile danger management device for livestock manufacturers across different industries. Bagley Risk Management. By acquainting themselves with the details of LRP, producers can make informed choices to guard their investments and make certain monetary stability despite market uncertainties

Advantages of LRP Insurance Policy for Animals Producers

Animals manufacturers leveraging Livestock Risk Defense (LRP) Insurance coverage obtain a critical advantage in securing their financial investments from cost volatility and protecting a steady financial footing amidst market uncertainties. By setting a floor on the price of their animals, manufacturers can alleviate the risk of significant economic losses in the event of market downturns.

In Addition, LRP Insurance policy provides manufacturers with tranquility of mind. Overall, the benefits of LRP Insurance for animals manufacturers are significant, supplying a valuable device for taking care of risk and making sure monetary safety in an uncertain market setting.

How LRP Insurance Coverage Mitigates Market Threats

Reducing market risks, Animals Danger Protection (LRP) Insurance gives animals producers with a reputable shield against price volatility and economic unpredictabilities. By offering protection against unexpected price drops, LRP Insurance assists manufacturers secure their investments and maintain economic stability when faced with market changes. This sort of insurance policy enables animals producers to secure in a rate for their animals at the beginning of the why not look here policy duration, ensuring a minimal cost level despite market changes.

Actions to Safeguard Your Animals Financial Investment With LRP

In the world of farming threat management, implementing Animals Danger Security (LRP) Insurance coverage involves a strategic process to safeguard investments against market fluctuations and unpredictabilities. To safeguard your livestock investment successfully with LRP, the initial step is to evaluate the certain threats your operation faces, such as cost volatility or unanticipated weather occasions. Next, it is critical to research study and select a trusted insurance supplier that supplies LRP plans customized to your livestock and service requirements.

Long-Term Financial Security With LRP Insurance Policy

Making sure withstanding monetary stability through the use of Animals Danger Defense (LRP) Insurance policy is a sensible lasting technique for farming manufacturers. By integrating LRP Insurance right into their danger administration plans, farmers can guard their livestock financial investments against unforeseen market fluctuations and damaging events that can jeopardize their financial wellness gradually.

One key advantage of LRP Insurance coverage for long-term financial safety is the satisfaction it uses. With a trusted insurance plan in position, farmers can mitigate the monetary risks connected with unstable market problems and unexpected losses as a result of factors such as condition outbreaks or natural catastrophes - Bagley Risk Management. This security permits manufacturers to concentrate on the day-to-day operations of their livestock organization without continuous worry about potential financial obstacles

Furthermore, LRP Insurance provides an organized approach to handling danger over the long-term. By establishing particular coverage levels and picking proper endorsement periods, farmers can tailor their insurance plans to line up with their monetary goals and take the chance of resistance, ensuring a lasting and safe future for their animals procedures. click now In verdict, buying LRP Insurance policy is a positive approach for farming producers to attain lasting monetary protection and safeguard their livelihoods.

Verdict

Finally, Livestock Danger Protection (LRP) Insurance policy is an important device for livestock producers to minimize market risks and protect their investments. By comprehending the benefits of LRP insurance and taking steps to implement it, producers can attain long-term economic safety and security for their operations. LRP insurance supplies a safeguard versus rate variations and makes sure a level of security in an unpredictable market environment. It is a wise selection for safeguarding livestock investments.